According to the report, 74% of Saudi online shoppers want to increase their shopping on Saudi e-commerce platforms. Because Saudi Arabia’s industry and manufacturing industry are relatively weak, consumer goods are heavily dependent on imports. In 2022, the total value of China’s exports to Saudi Arabia will be 37.99 billion U.S. dollars, an increase of 7.67 billion U.S. dollars compared to 2021, a year-on-year increase of 25.3%.

1. Saudi local e-commerce favorability rises

According to a new report from Kearney Consulting and Mukatafa, as the acceptance of online shopping continues to increase, Saudi consumers are shifting towards local shopping platforms and local hybrid shopping platforms instead of cross-border shopping platforms.

According to the report, 74 percent of Saudi online shoppers expect to increase their purchases on Saudi e-commerce platforms compared to buying from China, the GCC, Europe and the US.

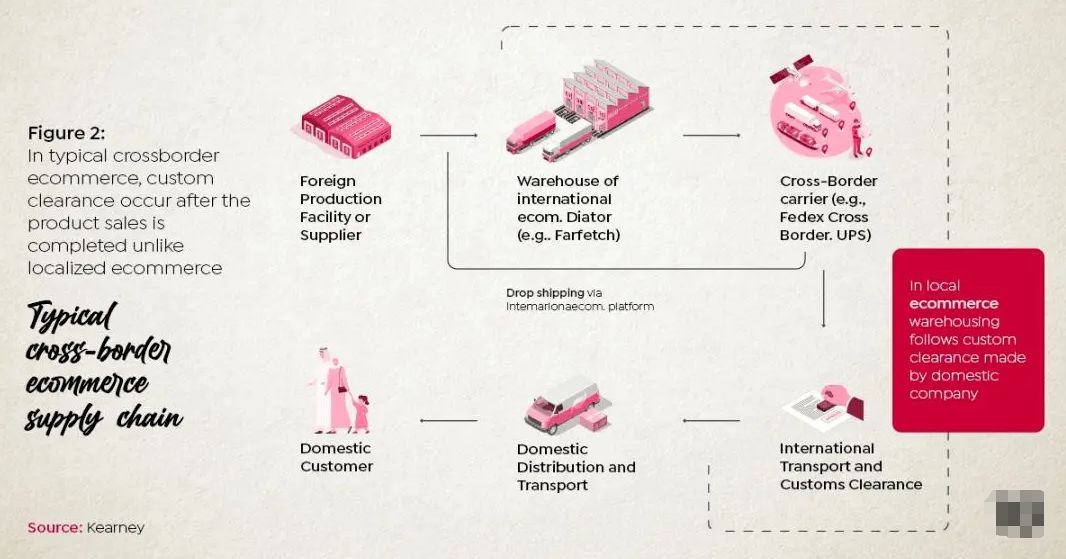

In 2021, cross-border e-commerce in Saudi Arabia accounted for 59% of total e-commerce revenue, although this proportion will decline with the development of local and hybrid enterprises, and may drop to 49% by 2026, but it still dominates.

Lower prices (72%), wider selection (47%), convenience (35%) and brand variety (31%) are the reasons why consumers choose cross-border platforms so far.

2. The blue ocean of e-commerce surrounded by deserts

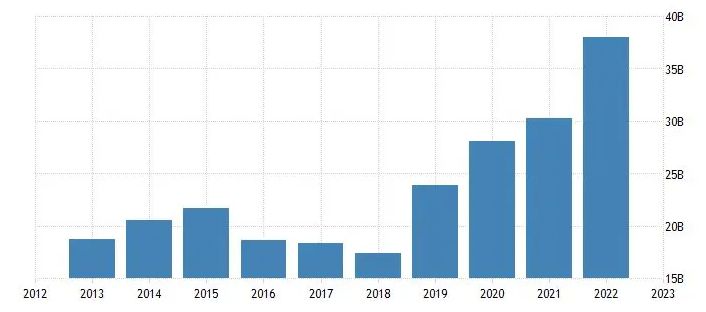

In recent years, my country has been the largest trading partner of Saudi Arabia. Because Saudi Arabia’s industry and manufacturing industry are relatively weak, consumer goods are heavily dependent on imports.

In 2022, Saudi Arabia’s imports will be US$188.31 billion, an increase of US$35.23 billion compared to 2021, a year-on-year increase of 23.17%. In 2022, the total value of China’s exports to Saudi Arabia will be 37.99 billion U.S. dollars, an increase of 7.67 billion U.S. dollars compared to 2021, a year-on-year increase of 25.3%.

In order to get rid of its dependence on the oil economy, Saudi Arabia has vigorously developed the digital economy in recent years. According to ecommerceDB, Saudi Arabia is the 27th largest e-commerce market in the world and is expected to reach $11,977.7 million in revenue by 2023, ahead of the UAE.

At the same time,the government of the country introduced relevant policies and laws to support and improve the Internet infrastructure and cultivate innovative talents. For example, in 2019, Saudi Arabia established the E-Commerce Committee, joined forces with the Central Bank of Saudi Arabia and other institutions to launch a number of action items to support the development of e-commerce, and promulgated the first e-commerce legislation. And among the many industries involved in the 2030 vision plan, the e-commerce industry has become one of the key support objects.

3. Local platform VS cross-border platform

The two well-known e-commerce platforms in the Middle East are Noon, a local e-commerce platform in the Middle East, and Amazon, a global e-commerce platform. In addition, Chinese e-commerce platforms SHEIN, Fordeal, and AliExpress are also active.

For now, Amazon and Noon are the best entry points for Chinese sellers to enter the cross-border e-commerce market in the Middle East.

Among them, Amazon has the largest online traffic in the Middle East. In the past few years, Amazon has developed rapidly in the Middle East, occupying the Top1 e-commerce website in the Middle East all the year round.

Meanwhile, Amazon still faces competition in the Middle East from local rival Noon.

Noon has officially entered the Middle East e-commerce market since 2017. Although it entered the market relatively late, Noon has extremely strong financial strength. According to the data, Noon is a heavyweight e-commerce platform built by Muhammad Alabbar and the Saudi sovereign investment fund at a cost of US$1 billion.

In recent years, as a latecomer, Noon has developed rapidly. According to the report, Noon has already occupied a stable market share in many markets such as Saudi Arabia and the United Arab Emirates. Last year, Noon also ranked among the top shopping apps in the Middle East. At the same time, in order to strengthen its own strength, Noon is also constantly accelerating the layout of logistics, payment and other fields. It has not only built multiple logistics warehouses, but also established its own delivery team to continue to expand the coverage of same-day delivery services.

This series of factors makes Noon a good choice.

4. Selection of logistics providers

At this time, the choice of logistics provider is particularly important. It is most important and stable for sellers to find a good service and reliable logistics provider. Matewin Supply Chain will build a special logistics line in Saudi Arabia from 2021, with fast timeliness and safe and stable channels. It can become your first choice in logistics and also your trusted partner.

Post time: Jul-14-2023