What is a certificate of origin?

The certificate of origin is a legally valid certification document issued by various countries in accordance with relevant rules of origin to prove the origin of goods, that is, the place of production or manufacture of the goods. To put it simply, it is the “passport” for goods to enter the field of international trade, proving that the goods economic nationality. The certificate of origin contains information about the product, destination and exporting country. For example, products may be labeled “Made in the United States” or “Made in China.” The certificate of origin is a requirement of many cross-border trade treaty agreements because it can help determine whether certain goods meet the import conditions or whether the goods are subject to tariffs. It is one of the documents that allows imports. Without a certificate of origin, there is no way to clear customs.

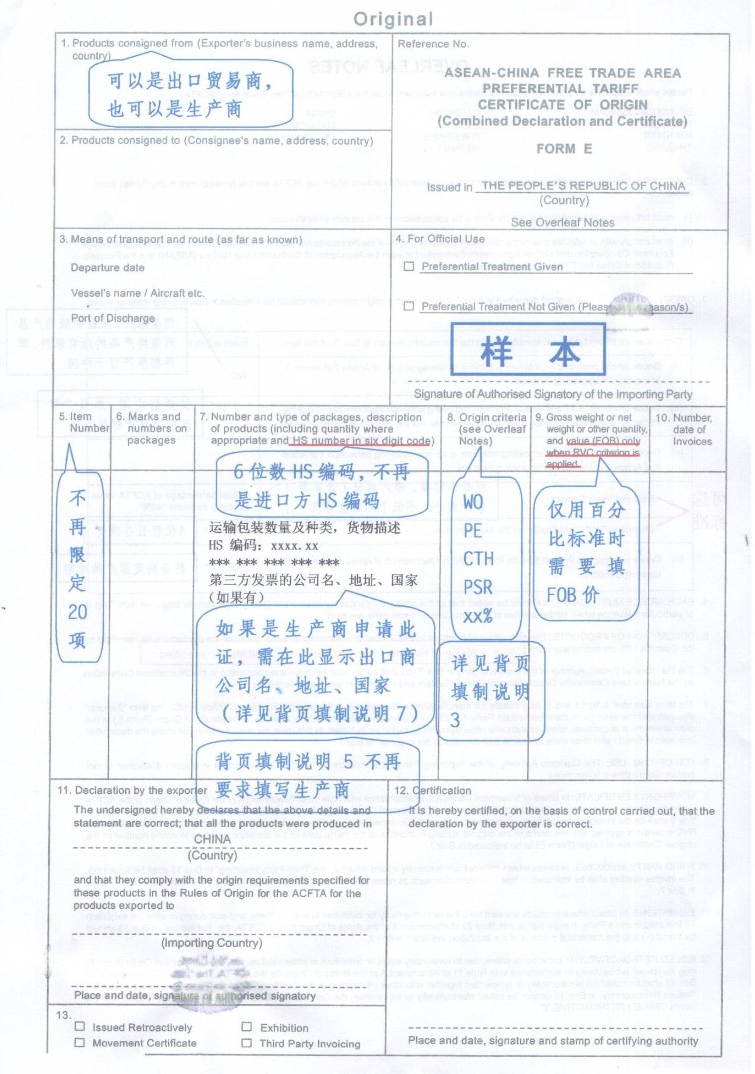

The Certificate of Origin is a separate document from the commercial invoice or packing list. The customs requires the exporter to sign, the signature must be fair, and the attached documents must be signed and stamped by the chamber of commerce. Sometimes, the destination customs may ask for an audit certificate from a specific chamber of commerce, and chambers of commerce usually only take seriously what is verifiable. Proof of audit typically includes the chamber’s official embossed seal and the signature of an authorized chamber representative. Some countries or regions accept certificates of origin electronically signed by chambers of commerce. The buyer may also specify in the letter of credit that a certificate of origin is required, and the letter of credit may specify additional certification or language to be used so that the certificate of origin meets the specified requirements.

Applications for electronic certificates of origin (eCo) are generally submitted online, and applicants can sometimes get an electronic certificate stamped by the chamber of commerce in less than a day, or even get an expedited paper certificate overnight.

What are the main categories of certificates of origin?

In our country, according to the role of the certificate of origin, there are three main categories of certificates of origin issued for export goods:

①Non-preferential certificate of origin: It is commonly known as the “general certificate of origin”. It is a document proving that the goods originate in my country and enjoy the normal tariff (most favored nation) treatment of the importing country, referred to as the CO certificate.

②Preferential certificate of origin: You can enjoy more favorable tariff treatment than the most-favored nation treatment, mainly including GSP certificate of origin and regional preferential certificate of origin.

③Professional certificate of origin: It is a certificate of origin specified for specific products in a special industry, such as the “Certificate of Origin of Agricultural Products Exported to the EU”, etc.

What is the function of certificate of origin?

①Handover of goods: The trading party uses the certificate of origin as one of the vouchers for handing over goods, settling payment, and settling claims;

②The importing country implements specific trade policies: such as implementing differential tariff treatment, implementing quantitative restrictions and controlling imports for specific countries;

③Tariff reduction and exemption: In particular, various preferential certificates of origin are necessary documents to enjoy preferential tariff treatment in the importing country. They are regarded by many importers as the “golden key” and “paper gold” to reduce the cost of goods. They also enhance the international reputation of our country’s goods. Competitiveness.

Notes on Certificate of Origin:

①The format of the certificate of origin uploaded during declaration should comply with the document regulations, be a color scan of the original, and the content of the certificate should be clear. Please note that please upload the “Original” version, and should not upload the “Copy” or “Triplicate” version;

②The signatures and seals in the issuing authority column and exporter column of the certificate of origin must be complete and clear;

③The exporter’s certificate of origin should be consistent with the invoice and contract;

④Attention should be paid to the date part of the certificate:

(1) Certificate issuance date stipulates: Asia-Pacific Trade Agreement is at the time of export or within 3 working days after shipment; China-ASEAN Free Trade Agreement is before shipment, at the time of shipment, or due to force majeure, within 3 days after shipment; China-Peru Trade Agreement and the China-Australia Free Trade Agreement are before or at the time of export; the Regional Comprehensive Economic Partnership (RCEP) is before shipment;

(2) Certificate validity period: Asia-Pacific Trade Agreement, China-ASEAN Free Trade Agreement, China-Peru Free Trade Agreement. The China-Australia Free Trade Agreement and the Regional Comprehensive Economic Partnership (RCEP) are valid for one year from the date of issuance;

(3) Reissue certificate period: The China-ASEAN Free Trade Agreement stipulates that the certificate can be reissued within 12 months; the China-Australia Free Trade Agreement stipulates that the certificate can be reissued within one year from the shipment of the goods; the Asia-Pacific Trade Agreement does not allow reissue.

⑤ If the certificate of origin is not issued according to the time specified in the document, and the issuing authority reissues the certificate of origin, the words “ISSUED RETROACTIVELY” (reissue) should be marked on the certificate;

⑥The ship name and voyage number on the certificate of origin should be consistent with the customs declaration form;

⑦The first 4 digits of the HS code of the certificate of origin under the Asia-Pacific Trade Agreement should be consistent with the customs declaration form; the first 8 digits of the HS code of the “Cross-Strait Economic Cooperation Framework Agreement” (ECFA) certificate of origin should be consistent with the customs declaration form; other preferential trade The first 6 digits of the HS code of the agreed certificate of origin should be consistent with the customs declaration form.

⑧The quantity on the certificate of origin should be consistent with the quantity and unit of measurement declared in the customs declaration form. For example, the quantity listed on the China-ASEAN Free Trade Agreement certificate of origin is “Gross weight or net weight or other quantity”. If the issuing authority does not make a special statement on the quantity when issuing the certificate of origin, it will default to the quantity listed on the certificate of origin. The gross weight and quantity of the certificate of origin should be consistent with the gross weight of the customs declaration form. If the quantity of the certificate of origin is less than the gross weight, then the portion exceeding the quantity listed on the certificate of origin cannot enjoy the agreed tax rate.

⑨The “Origin Criteria” item entered by the enterprise in the single window should be consistent with the “Origin criterion” or “Origin Conferring Criterion” of the certificate of origin. Please be sure to enter it correctly during the application process;

⑩The invoice number and date entered in the invoice number column of the certificate of origin should be consistent with the invoice number and date attached to the customs declaration form.

Post time: Oct-19-2023